income tax

Home loan gets you tax benefits and a home too!

Rising property prices make home loans inevitable. While buying a home availing a home loan also enjoy tax benefits that come with it. Thanks to firm real estate prices, buying a house is a daunting task for many inIndia. Those who have managed to buy a house have inevitably availed a home loan. These people […]

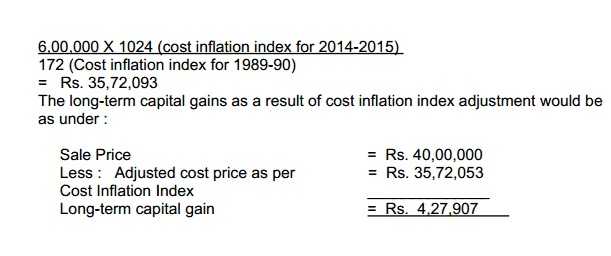

4 Ways to save Tax by Investing in Property

It is that time of the year when most people would have already planned their investments or would be looking at multiple options so as to save on their income tax. There are several instruments such as Public Provident Fund (PPF), Insurance, National Savings Certificate (NSC), among many others available that help you save on […]