All You Need To Know About Paying PCMC Property Tax

PCMC Introduction

Pimpri-Chinchwad Municipal Corporation is a local body set up to maintain and manage the service of civil and infrastructure in the city. The authority is responsible for taxing the value of the property and the property of the person. It was established on 11 October 1982 to govern the new industrial cities of Chinchwad, Akurdi, Pimpri, and Bhosari. The city is divided into 8-administrative regions (named A to H). Each zone has 4 electoral wards and an office is controlled by an Assistant Municipal Commissioner. PCMC was one of the first civic bodies to collect property tax digitally.

Property tax is applicable to all properties and vacant land within the municipal limits. Property tax is assessed on the basis of carpet area of the building/property. The PCMC follows a capital-based value system for calculating property tax.

Role of Department

- Assessment of property tax on open land and buildings within the jurisdiction of Pimpri Chinchwad Municipal Corporation.

- To issue Assessment Register Uttara (Property Details)

- To collect property tax

- To issue No Dues Certificate of property tax

- To transfer property

The Process Of Paying PCMC Property Tax Online

Homebuyers can quickly pay property tax through offline and online modes. Following are the steps to make an online payment for property tax:

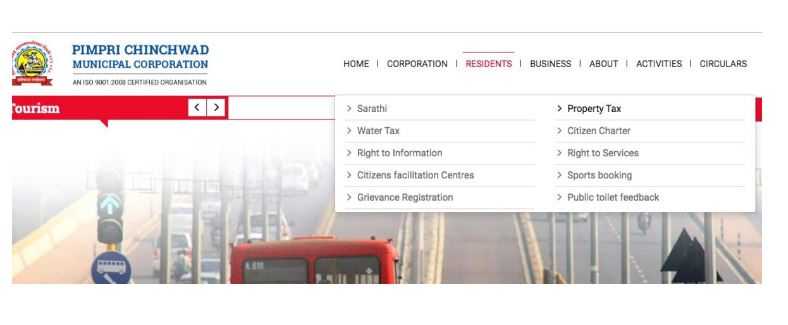

Step1: Visit the PCMC property tax payment website: https://www.pcmcindia.gov.in/index.php

Step2: Under ‘Residents’ tab, click on ‘Property Tax’ option.

Step3: On the next page click on ‘Property Bill’.

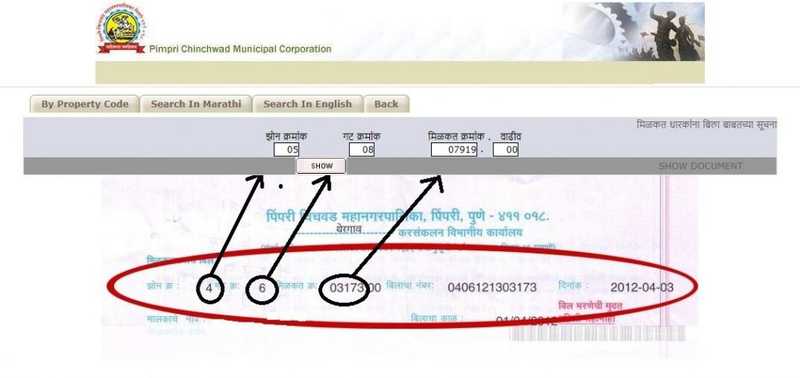

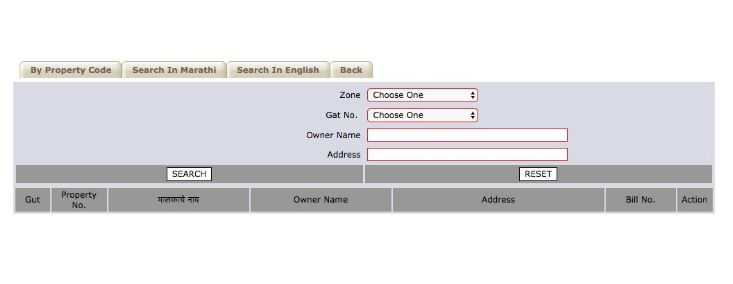

Step4: You will see four options to search your property details – ‘By Property Code’, ‘Search in Marathi’, ‘Search in English’, and ‘Back to Home page’.

Step5: Input details Zone, gat no, owner name, and address.

Step6: Proceed with the payment details.

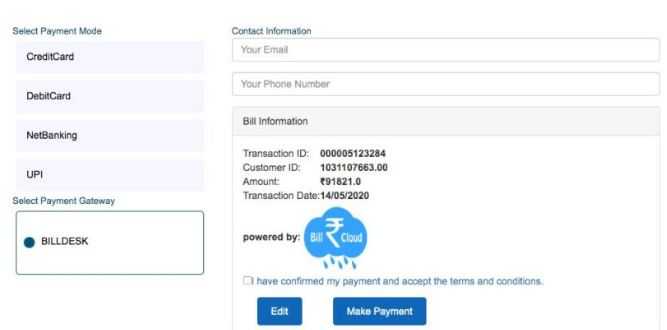

Step7: Enter your email id and mobile number, choose the payment option and make the payment.

PCMC Property Tax Calculation

Property tax is a percentage of the actual value of the property that is based on the ready reckoner or circle rate which is used by the Department of Revenue to calculate stamp duty.

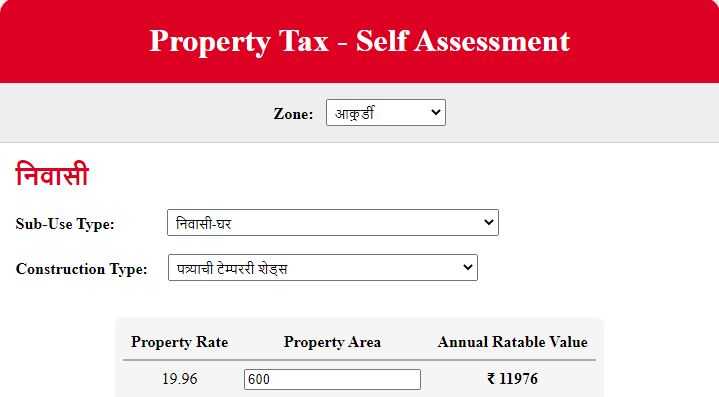

Property tax = Tax rate * Capital Value

Capital Value = Base value * built-up area * usage * building type * age factor * floor factor

PCMC allows its users to calculate property tax online by entering the locality, region, usage, type, total plinth area, and age of the property.

PCMC Property Tax Rate 2020-21

Property tax rates of PCMC 2020-21 can be accessed here

Pune Property Tax Collection Centres

You can make a property tax payment online by visiting the PMC website and enter the Property type, section ID, Peth ID, account no. Fill up your mobile number, email id, and mode of payment net banking or card payment. On successful transaction, you will get the transaction status and payment receipt from PMC will be displayed on the screen. Save it or take the print out for the same. You can pay through Internet Banking, Debit Card, and Credit cards. Visit the PMC website for property tax: http://propertytax.punecorporation.org/OnlinePayment/NIPL/OnlineServices/OnlinePTax/NI_PT_PROP_DUES_DETAILS.aspx

Click this link to know your property tax collection centers of Pune

How to Make PCMC Property Tax Payment Online at Paytm

Paying property tax online on Paytm is very easy and convenient. You just have to follow these simple steps:

- Select the corporation

- Fill in the required details such as- Property ID, Name, Address, Email ID, Phone Number, etc.

- Click on ‘Get Tax Amount’

- After checking the payable tax amount, select your preferred mode of transaction i.e., Debit Card, Credit Card, Net Banking, Paytm Wallet or UPI (UPI is only available with Paytm App)

- Proceed with the payment and you are done with it.

PCMC Property Tax Due Date

The due date for the 1st half (1st April to 30th September) is 31 May and the due date for the second half (1 October to 31 March) is 31 December.

PCMC Property Tax Penalty

In case of delay in payment beyond the due date, a penalty of 2% per month is levied, that is, in the case of 1 half-year from July 1 and 2-half-yearly from January 1.

PCMC Rebates & Rewards On Payment Of Property Tax On Time

If the entire property tax is paid by 31st May, following rebates are available:

- For residential properties/ non-residential/open plot specifically registered as residential building 10% discount on general tax in case of annual rateable value up to Rs 25,000 and 5% discount on general tax in case of the annual rateable value of Rs 25,001 and above.

- In case of residential properties having solar, vermiculture and rain-water harvesting 5% discount on municipal tax (excluding water tax and government taxes) in case of one of these projects and 10% discount on municipal tax (excluding water tax and government taxes) in case of two of these projects.

PCMC Property Tax News

- Recently, PCMC reported a 79% drop in revenue due to the coronavirus epidemic. The collection reportedly fell from Rs 57 crore to Rs 11 crore for the same period, year-on-year. The authority also plans to delay the proposal for a property tax increase, as property owners are seeking an apology for this year, due to economic difficulties during COVID-19.

- On 7th April 2020, Pimpri Chinchwad Municipal Corporation (PCMC) Property Tax Department raised a tax of Rs 198 crore through an online payment system, making it the largest part of the overall wealth tax collection of Rs 490.11 crore for the financial year 2019-20.

- On May 31st, the civic body has extended the last date of payment of property tax to June 30, giving much-needed relief to people. Earlier the last date was today, May 31, 2020, due to various reasons including the lockdown due to Coronavirus pandemic.

PCMC Contact Details

While the PCMC property tax payment process is simple and user-friendly, Payee can reach the civic body in case of problems.

PCMC Sarathi Helpline Number: 8888 00 6666

PCMC Sarathi website: Portal Link

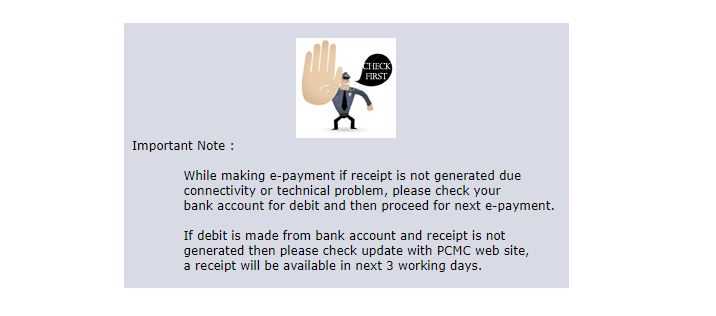

PCMC Property Tax e-Payment Receipt Important Note :

If the receipt does not arise due to connectivity or technical problem while making e-payment, please check your bank account for debit and then proceed to the next e-payment.

If the bank account has been debited and the receipt has not been generated, please check the update with the PCMC web site, a receipt will be available within the next 3 working days.

Frequently Asked Questions

What Is the Importance Of Property Tax?

Property tax helps local bodies with funds to provide you with local services such as cleaning the area, proper supply of water, maintenance of roads, drainage, etc. It also helps you in case of any property dispute to prove ownership.

Is Property Tax Applicable To Vacant Land?

Property tax is applicable to any type of vacant land unless the land is used only for agricultural purposes.

Which Properties Are Exempted From Property Tax?

Any property that is used for religious worship, public burial, cremation, and heritage land is exempt from the property. Any building that is used for charitable, educational, or agricultural purposes is also exempt from property tax.

Who Is Liable To Pay Property Tax In Case Of Joint Ownership Of Property?

Both the owners are liable to pay a share of the property tax as per their respective shareholding in the property.

Image Source: PCMC website