BBMP Property Tax Online Payment 2020-21

Introduction

Tax is one of the major sources of revenue for the government, which helps them in financing various facilities provided to the general public of the country. Taxes are levied on various things such as the tax on income, Goods and Service Tax on goods and services, etc. Some taxes are governed centrally and some other taxes are state-specific and revenue is received by various states for the purpose of the state budget.

Property tax is one of such taxes levied by the state government through the local body on immovable property, which also includes vacant land year by year. This tax is levied on the owner of the property.

About Bruhat Bengaluru Mahanagara Palike Property Tax

Here is how you can pay property tax online in Bangalore Karnataka. The owners of properties in Bengaluru are liable to pay property tax every year to a Bengaluru municipal corporation named Bruhat Bengaluru Mahanagara Palika (BBMP). The local body uses these funds to provide civic amenities in Bengaluru.

Based on the guidance value published by the Department of Stamps and Registration, the jurisdiction of BBMP is divided into six value zones. The property tax rate will vary according to the area in which the property is located.

Now, Bruhat Bangalore Mahanagara Palike (BBMP) has simplified the process by introducing online mode and several Bangalore One Centres.

Individuals are required to pay property tax from April 1 of the assessment year. Interest on delayed payment of property tax is 2% per month or 24% per year. There are several authorized banks in India to collect property tax from the people.

How To Pay BBMP Property Tax Online For 2020-21?

Simple steps to pay BBMP property tax online are given below:

- Visit BBMP property tax portal i.e. https://bbmptax.karnataka.gov.in/

- First, enter the SAS application number or PID (both available on the last receipt) and click on ‘Fetch’, which will display the property details

- If the description displayed is correct and there is no change in the property, then click ‘Continue’ and it will take you to Form IV.

- If there is a change in the property such as the use of the property, the built-up area, or its occupancy, check the box on the page and then click ‘proceed’ which will take you to Form V.

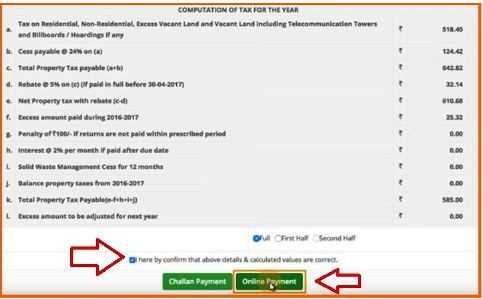

- Ensure that the details filled in the displayed form including tax calculation are correct and/or the relevant details have been revised in case of change and proceed to make payment either in full or in installments and online or through challan.

- Choosing the online payment option will take you to a payment page where you can choose to pay via net banking or credit/debit card and complete the payment.

- After the payment is complete, a receipt number will be generated and it will take 24 hours for the e-receipt to be available on the portal. A receipt can be printed/downloaded here:

- If you face any problem while making online payment and the payment is incomplete, you can resume payment using the current SAS application number:

- In addition, for any problems encountered while using the online mode, you can either contact BBMP at contactus@bbmp@gmail.com or file a complaint here:

BMP Property Tax Forms

Here are forms that property owners should be aware of:

| Form | Applicability |

| Form I | Property with Property Identification Number (unique ID assigned to each property which is a combination of your ward number, street number, and plot number) and this can be found on the last property tax payment receipt. |

| Form II | A property without a PID but only a Khata number (includes the number of Khata certificates issued for each property and all details related to that property). |

| Form III | A property without PID or Khata number |

| Form IV | When there is no change in the property details such as the size of the built-up area, the use or occupancy thereof, etc. |

| Form V | When there is a change in the property like from under-construction to constructed |

| Form VI | For payment of service charges when a property is exempted from payment of property tax |

FAQs On Property Tax

What Is Property Tax And Who Should Pay It?

Property tax is a type of tax that is paid by the property owner to the local body or municipal department of a city. The tax amount depends on the value of the land, area, and region.

This power is assigned to the amount of tax payable in the hands of local governing bodies and municipalities. This may vary each year depending on the levies by the local authorities.

How Is Property Tax Calculated BY BBMP?

The BBMP follows the unit area value (UAV) system for calculating the property tax amount. The UAV is based on the expected return from the property, which depends on the location and nature of the property’s use. Property tax is calculated by multiplying the property’s area per square foot tax rate per month (UNIT) which is determined based on the property’s location (area) and multiplied by the current property tax rate (value).

Factors That Decide Property Tax Calculation

The amount of property tax implications is decided on the basis of the local body along with a number of other factors that determine the total property tax liability for the owner of a property. These other factors include

- Location as well as property size

- Nature of the property whether it is ready to move in property or under-construction

- Gender- In case a property is owned by a female owner then there are some rebates

- Senior citizens, as there is some applicable discounts for them

Civic facilities offer by the local body

What Kind of Properties Attract Property Tax in Bangalore?

Property tax in Bangalore is charged on the following properties:

Residential houses, whether they are occupied by the owner or let out to rent

Flats/Apartments/Villas

Factory buildings

Godowns

Office buildings

Shops

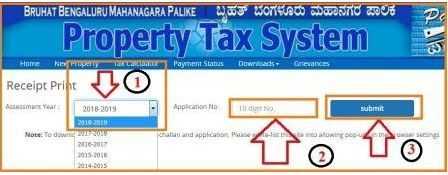

How Do I Get My BBMP Tax Receipt?

You can achieve this by following the steps listed below:

- Visit https://bbmptax.karnataka.gov.in/

- Click on ‘Download’

- And choose ‘Receipt Printout’

- Next, select the assessment year

- Enter the application number

- Click on ‘Submit’

- You can now download your property tax receipt in PDF format.

Which Formula Is Used To Calculate The BBMP Property Tax?

BBMP property tax calculation formula is (G-I)*20% + Cess (24% of property tax). In this, G is Gross Unit area value arrived by X+Y+Z and I is G*H/100. X is a tenanted area of property x per sq ft rate of property x 10. Y is self-occupied area x per sq ft rate of property x 10. H is the percentage of depreciation rate, which depends upon the age of the property.

What Is The Due Date For Payment Of BBMP Property Tax?

In view of the national lockdown due to the COVID-19 epidemic, the BBMP has extended the deadline for payment of property tax in Bangalore to May 31, 2020.

How Can I Check My BBMP Property Tax Online?

You can check your BBMP property tax on bbmptax.karnataka.gov.in

When Is The Last Date For The BBMP Property Tax Rebate?

The Bruhat Bengaluru Mahanagara Palika (BBMP) has extended the 5% exemption on payment of full property tax to the end of May for 2020-21.

BBMP Property Tax Returns 2020-21 Last Date

All property tax payments of 2020-2021 are eligible to file revised property tax returns. The revised property tax returns for 2020-2021 can be filed till 31st March 2021.

What Is The Due Date For The BBMP Property Tax?

April 30 of the last fiscal has been set by the BBMP for property tax payments. BBMP offers a 5% rebate on lump-sum payment of property tax before the due date.

What is the penalty for the late payment of property tax in Bengaluru?

If you fail to make the payment within the stipulated time, the authority charges an interest of 2% per month on the taxable amount.

How Do I Pay My BBMP Tax Through Challan?

Property tax can be paid in two sections:

- If you are paying online, you can choose the online payment option by clicking “ONLINE PAYMENT” and make your payment using your credit/debit card or net banking.

- If you are paying in cash/DD/cheques. You have to click the “CHALLAN” button.

Where Do I Get The PID Number For Property Tax Bangalore?

To find your PID number, please follow these steps:

- Visit the bbmp.gov.in website.

- Click on the tab ‘GIS-based new PID’

- Go to the bottom of the page and click on ‘To Know your New PID Click Here’

Can Bangalore One Pay Property Tax?

Citizens can pay property tax through Bangalore One application in check pay mode only. Checks should be in favor of Bangalore One and only from RBI recognized banks.

Which Are The Authorized Banks To Collect BBMP Property Tax?

- Canara Bank

- Maharashtra Bank

- HDFC Bank

- IDBI

- Indian Overseas Bank

- Kotak Mahindra

- SBI

- Axis Bank

- Indusind Bank

- Corporation Bank

- ICICI Bank

- YES Bank

- Indian Bank

Image Source: BBMP Website