e-Stamping – A simpler way to pay stamp duty

What Is An E-Stamp?

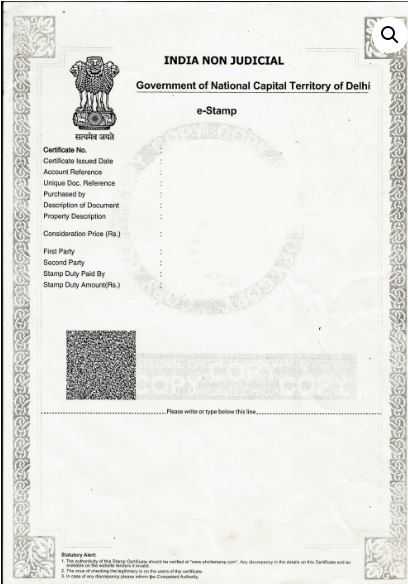

E-stamping is an electronic way of stamping documents and paying stamp duty to the government. To get the e-stamp, you have to provide details like the first party and second party name, type of document, stamp duty paid by, amount of stamp duty, etc. The method of generating online stamp papers is also referred to as e-stamping.

The Government of India introduced e-stamping to make it easier and glitch-free to deal with counterfeiting and payment of stamp duty. In fact, in some states, such as Delhi, all stamp duty is required to be paid through e-stamping.

The Central Government has appointed Stock Holding Corporation of India Limited (SHCIL) as the Central Record Keeping Agency (CRA) for all e-tickets used in the country. The bank has entered into an agreement with the Stock Holding Corporation of India Limited [SHCIL] to offer pan India, an e-stamping facility.

E-stamping has been introduced in 19 states across India, however, most states limit the amount for which e-stamp paper can’t be used for transactions. States, where e-stamping is on a large scale, including Delhi, Karnataka, Haryana, Uttar Pradesh, Himachal Pradesh, etc. One can buy e-stamp papers of their respective states sitting in their workplace or other states. There are many online platforms that are offering such facilities.

Payment of stamp duty is an essential part of almost any transaction you undertake in India, ranging from buying or selling a house to a business agreement or even registering many of your insurance policies.

However, not all states have all three options available. If all methods are available, all are legally recognized and the election is with the person concerned. In fact, technology-savvy will find electronic-stamping the most convenient and simplest option.

Currently, SHCIL is responsible for everything from user registration to administration, maintenance of all e-stamping applications and records. SHCIL has also designated authorized collection centers or ACC-scheduled banks, which will issue certificates to users.

Of course, it would be the best idea to contact a lawyer and be worth the money, if you want to ensure that there will be no complications in the future.

Methods of Stamp Duty Payment

There are three ways to pay stamp duty: (1) using the e-stamping facility (2) using a paper-based impression stamp (non-judicial stamp paper), and (3) using a franking machine.

Features of e-Stamping

- Easy access and fast processing

- Safe

- Saving money

- Time saver

- user friendly

Benefits of e-Stamping

- Can be generated within a few minutes

- The veracity of the e-stamp paper can be verified.

- Free from unauthorized changes

- Unique Identification Number of E-Stamp Paper

e Stamp Papers Delhi Sample

Method of Generating Online Stamp Papers

- Visit the SHCIL website, www.shcilestamp.com, and check if your state government allows e-stamping. The site also contains information on which transactions require the address of the stamping and collection centers.

- If the option is available in your state, you will need to fill out an application form in an ACC. The application form should contain the details of the parties involved and the transaction should be used for this.

- Submit the form along with payment for the stamp certificate. You can pay in currency or use a check or demand draft if done in ACC. Online payment can be made via debit card, credit card, pay orders, RTGS, NEFT, or account-to-account transfer.

What Is Franking?

In this method, one has to submit an application to an authorized franking agency, sub-registrar office, or a bank. The document for which the stamp duty is being paid is to be attached to the application and the agency/bank imposes a seal indicating that the required fee has been paid.

What Is An eChallan?

eChallan is an online Government Receipt Accounting System (GRAS) connected to various revenue-generating departments for the government.

Other states including Maharashtra, Haryana, and Himachal Pradesh are providing this e-payment facility to citizens. However, there is also a catch that most of the states are currently using this system for mandatory registrable documents.

Users can pay various taxes and stamp duty by logging into the portal of their respective state governments. On successful payment, an eChallan will be generated which will be password protected. EChallan includes an eChallan Identification Number (CIN), payment details, and bank name through which e-payment has been made.

Image Source: YouTube