Guide To Pay Property Tax Online In Kolkata

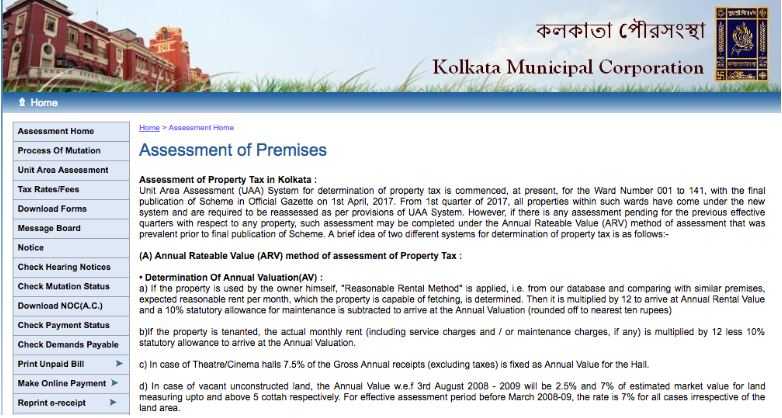

About KMC Property Tax

Property tax is an annual tax levied on a real estate property. The tax is levied by the government authorities of the jurisdiction where the property is located. The owners of residential properties in Kolkata are responsible to pay property tax to their respective civic bodies every year. The municipality collects tax and utilizes it to develop the physical and civic infrastructure of the city. However, the tax amount differs from one place to another.

On 15 December 2016, the Kolkata Municipal Corporation (Amendment) Bill 2016 was passed, to simplify the assessment and collection of property tax and to make the whole process more transparent. This authorized the KMC to limit the increase and decrease in property tax to some extent and to enable self-assessment of a property tax. Previously, the KMC also passed an amendment to ease the assessment and collection of property tax. With this, property owners can also calculate property tax for the residential property through a self-assessment formula, known as a unit area assessment (UAA).

The Kolkata Municipal Corporation is also responsible for the collection of property tax and other civil directives such as death and birth certificates, valuation of land, and many other functions. Now property owners can file pending house tax bills, current demand bill, and access letters of interest on dues. The Kolkata Municipal Corporation (KMC) has its own website that allows taxpayers to pay their property online, while also being able to self-assess or assess the taxable amount of their land.

Online Payment Procedure Of KMC Property Tax

Step1: Visit KMC website i.e. www.kmcgov.in

Step2: Click Online Services on the left menu bar

Step3: Choose assessment-collection from the drop-down menu

Step4: Click Make Online Payment

Upon clicking on ‘make an online payment,’ three options will appear

- Current PD – This periodic demand is for bills. These bills are issued annually and are based on the final valuation of the property

- Outstanding LOI – Letter of Arrears (LOI) is for unpaid bills that are PD or F / S.

- Fresh-Supplementary – Fresh-supplementary bills are those issued after a hearing on a change in a previously issued bill or a first assessment of the property.

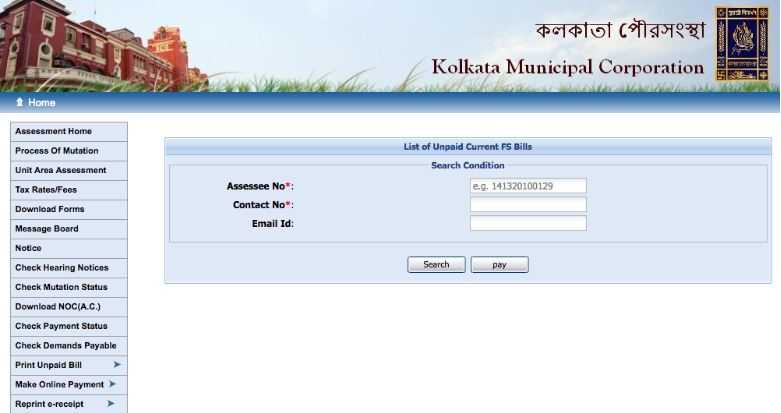

Step5: Upon selecting any of the options, You will be taken to a new page where you will have to feed the assessee number, contact number, and email id. The page will redirect you to the confirmation page where you can check the amount to be paid and other details.

Step6: Pay the displayed amount and collect the e-receipt. If you forget to submit the receipt, you can go to the reprint section and take advantage of it again.

Process Of Finding Assessee Number On The KMC Website

Property owners can find the assessee number on the KMC official website following these simple steps:

- Visit the official website of the Kolkata Municipal Corporation i.e www.kmcgov.in

- Click ‘Online Services’ from the left menu and select ‘Assessment-Collection’.

- You will be taken to a new page, where you can find the ‘Assessee Information Search’ option.

- Select ward number and street, you will be able to find your name and the assessee number.

Online Property Tax Calculation In Kolkata

In March 2017, the new Unit Area Assessment (UAA) system for property tax calculation was passed at KMC. It permits property owners in the city to calculate their tax, removing any subject matter or ambiguity that previously existed under the annual Rateable Value System.

The system includes about 6 lakh property taxpayers in the city. The UAA calculation method is expected to bring uniformity to the tax system so that all assets under the block are taxed equally.

The UAA mechanism for paying property tax in Kolkata has not only simplified the tax process in the city but also made it easier for residents to evaluate the outstanding tax. In addition, the online system is also a benefit as homeowners can pay taxes without wasting time and effort.

KMC Property Tax Calculation Formula

The annual KMC property tax under the UAA system is calculated using the following formula:

Annual tax = BUAV x Covered space/Land area x Location MF value x Usage MF value x Age MF value x Structure MF value x Occupancy MF value x Rate of tax (including HB tax)

(Note: HB tax refers to Howrah Bridge Tax, which applies to properties located in specific wards.)

Ensure that your record in the system is updated and no outstanding balance is shown against your account. If there are any errors, fix them immediately.

Important Highlights of Unit Area Assessment

Under the UAA scheme, the city is divided into 293 blocks which are further divided into 7 categories – A to G. This division is based on the market value of properties, facilities, and infrastructure. Each category is specified an annual value per square foot, also known as the Base Unit Area Value (BUAV) by KMC, where category A has the highest while category G has the lowest BUAV.

All slum areas of the city are classified as ‘G’ irrespective of the location to reduce tax liability on the economically weaker sections. Similarly, all Refugee Rehabilitation Colonies and government schemes for the economically weaker section are classified as ‘E’ regardless of their geographical location.

Base Unit Area Calculation

| Values for Base Unit Area for covered space of building including building or vacant land | |

| Block Category | Base Unit Area Values (Rs / Sq.Ft) |

| A | 74 |

| B | 56 |

| C | 42 |

| D | 32 |

| E | 24 |

| F | 18 |

| G | 13 |

Property tax calculations use the concept of multiplier factors (MFs) to account for several significant differences in the house within the same block. The MF will account for differences in terms of the purpose of use, location of the property within the block, age of the property, nature of occupancy, and type of structure. These factors are clearly notified and used to implement or enhance the BUAV of various assets.

Multiplicative Factors

| Location Multiplicative Factor | Multiplicative Factor Value |

| Property adjoined by roads having width ≤ 2.5m | 0.6 |

| Property adjoined by roads having width >2.5 m but ≤ 3.5 m | 0.8 |

| Property adjoined by roads having width >3.5 m but ≤ 12 m | 1 |

| Property adjoined by roads having width >12 m | 1.2 |

| Age Multiplicative Factor | Multiplicative Factor |

| Age of premises 20 years or less | 1 |

| Age of premises more than 20 years but less than 50 years | 0.9 |

| Age of premises more than 50 years | 0.8 |

| Usage Multiplicative Factor | Multiplicative Factor |

| Residential Use | 1 |

| Industrial/manufacturing, Shop<250 Sq.Ft., Restaurant | 2 |

| Office, bank, Hotel 5 star or more | 5 |

| Offsite ATM, Tower, Hoarding, Night Club | 7 |

| Vacant Land more than 5 cottah | 8 |

| Water Body | 0.5 |

| Health, Edu – Inst, Single Screen Cinema, Hotel < 3 star, Bar | 3 |

| Commercial shops(not in U3), mall, Multiplex | 6 |

| Vacant Land up to 5 cottah not falling under above categories | 2 |

| Hotels 3 star and 4-star, Ceremonial House | 4 |

| Property Type | Tax Rate |

| Un-developed bustee or Vacant land | 6% |

| Developed bustee | 8% |

| Government properties under KMC Act,1980 | 10% |

| Properties having annual value < Rs 30,000 | 15% |

| Others | 20% |

Kolkata Property Tax Payment Centers

- P-187, CIT Road, Kankurgachi V. I. P. Market, Kolkata – 700 054, Ward – 33

- 11, Belvedere Road, Kolkata – 700 027, Ward – 74

- 516, D. H. Road, Kolkata – 700 034, Ward – 130

- 79, Bidhan Sarani, Kolkata – 700 006, Ward – 11

- 28A, K. N. Sen Road, Kasba, Kolkata – 700 042, Ward – 67

- 212, Rashbehari Avenue, Kolkata – 700 019, Ward – 68

- Baghajatin Market Complex, Unit 2, Raja SC Mullick Road, Kolkata – 700 092, (Beside RAKTAKAMAL CLUB)

- 56/1 Raja Rajballabh Street, Kolkata – 700 003, Ward – 8

KMC Property Tax Latest News

- On 2nd April 2020, Kolkata Municipal Corporation has decided to extend the deadline for tax payment by another three months to June 30.

- On 5th July 2020, to encourage people to plant trees in the municipal area of Kolkata, the West Bengal Assembly passed a bill for the exemption of property tax on land where afforestation is done.

- On 18th July 2020, The Kolkata Municipal Corporation (KMC) has decided to waive the entire interest on outstanding property tax from August to encourage defaulters to pay up. This waiver will be valid for a limited period of 6-months.

Online Property Tax Payment Guide For Major Cities of India

Property Tax Online Payment Pune

Property Tax Online Payment Hyderabad

Property Tax Online Payment Gurgaon

Property Tax Online Payment Karnataka

Property Tax Online Payment Ahmedabad

Property Tax Online Payment Mumbai

Property Tax Online Payment Pimpri-Chinchwad