Madhya Pradesh: Stamp Duty And Registration Charges 2020-21

Stamp duty and registration fees are a crucial part of a property transaction in Madhya Pradesh and one of the highest in the country. Whenever a property is sold or purchased in the state, the buyer pays stamp duty and registration fee to the state government. Payment of stamp duty assures that a transaction is duly recorded in government records. Non-payment of stamp duty may not result in the registration of property transactions and ownership dispute at a later stage.

Update

On 7 September 2020, the Madhya Pradesh government announced a reduction in the cess levied on stamp duty for property registration from existing 3% to 1% in municipal areas to boost the stagnant real estate market badly hot by COVID-19. The reduction in cess will remain in force till December 31, 2020. Now the new stamp duty in Madhya Pradesh is 7.5% and the registration fee continues to be 3%. The rate of stamp duty prevailing in municipal areas has now been reduced to 10.5%. It was 12.5% earlier.

Stamp Duty & Registration Charges In MP 2020-21

| Gender | Stamp Duty rates (Till Dec 31, 2020) | Registration Charges |

| Male | 7.5% | 3% |

| Female | 7.5% | 3% |

| Joint (Male+Female) | 7.5% | 3% |

| Joint (Male+Male) | 7.5% | 3% |

| Joint (Female+Female) | 7.5% | 3% |

Note: The total registry fee also includes the applicable municipal fees and panchayat fees. Stamp duty includes Principal stamp duty (5% -2% cess), Municipal duty (3%), District duty (1%) and Upkar (0.5%).

Money Saved on Property Purchased after Reduction in Cess

Before September 2020, if you have purchased a property, you will have to pay Rs 8.75 lakh for stamp duty on the property of Rs 7000000.

Cost of property: Rs 70,00,000

Previous stamp duty rate: Rs 12.50%

Stamp duty charges: Rs 8,75,000

Under the current scenario:

Cost of property: Rs 70,00,000

Current stamp duty rate: Rs 10.50%

Stamp duty charges: Rs 7,35,000

Therefore, you will save Rs 1.40 lakh. Note that there is no concession for women home buyers and the stamp duty on the property is the same for both men and women in Madhya Pradesh.

How can I pay stamp duty and registration fee in Madhya Pradesh?

In Madhya Pradesh, stamp duty and registration fee can be paid in three ways.

E-Stamping

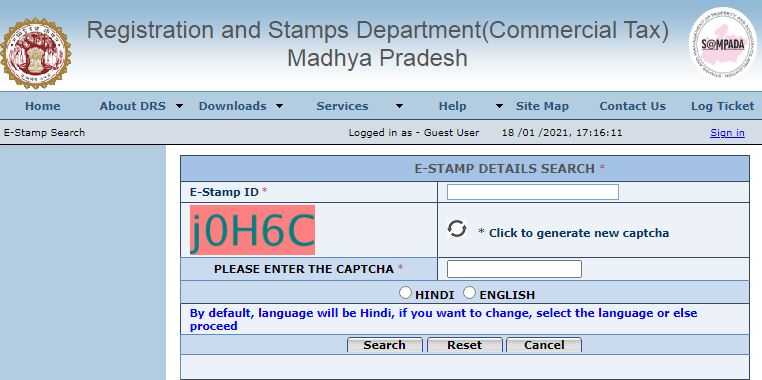

Electronic stamping is the method of electronic verification of payment of stamp duty and registration fees in Bhopal. This is done through ticketing and management of the Madhya Pradesh Government Property and Documents Application (SAMPADA) project. Through this, any citizen with valid identity proof can register and pay the required stamp fee and registration fee online. For this work, one has to login to https://www.mpigr.gov.in and pay a fee.

Franking

The government of Madhya Pradesh has designated banking institutions and post offices across the state to collect stamp duty and registration fee. One can go to one such institute and pay the applicable fees.

Physically

Whenever a property is sold or purchased, the buyer can physically go to the sub-registrar’s office and pay the requisite fee in person.

Online Payment Procedure of Stamp Dult in Madhya Pradesh

To pay the online stamp duty in Madhya Pradesh, follow these simple steps:

- Registration and stamps, log in on the official website of the Commercial Tax Department, Government of Madhya Pradesh, or click here.

- Login to The E Stamp Verify and pay the required fee.

What to focus on the go for e-stamping?

According to the instructions of the authorities, online payment can work only if you have selected English as the language on the login page. The description given by you should also be in English. Also, note that digital signatures are mandatory. Be careful not to hit the refresh or back button until the payment is complete.

MP Stamp Duty Reduction And Ots Impact on the Property Market

The real estate industry has been badly hit by the Covid-19 pandemic. There are a total of 5,000 under-construction projects and about 7 lakh units in the MP. Despite the high volume of inventory, active sales have been reduced due to the COVID-19 epidemic. Real estate developers had asked for a reduction in stamp duty after the lockdown to encourage homebuyers to purchase properties during the epidemic. The reduction in stamp duty is expected to reduce the cost-effective of buyers and, therefore, may spur demand.