NRIs to invest $13 billion in Indian real estate in FY2021

Non-resident Indians have been a major segment of investors in the Indian real estate market. A recent study by 360 Realtors finds that in FY 21, a total of $13.1 billion of NRI capital is expected to enter the Indian real estate industry — a growth of 5% on a YoY basis.

Non-resident Indians have been a major segment of investors in the Indian real estate market. A recent study by 360 Realtors finds that in FY 21, a total of $13.1 billion of NRI capital is expected to enter the Indian real estate industry — a growth of 5% on a YoY basis.

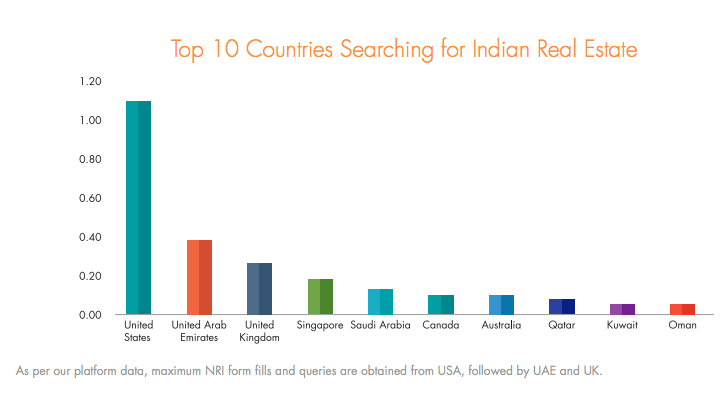

NRI investments will rise to $13.1 billion in FY 21 from $6 billion in FY 14, growing by a little less than a CAGR of 11%. According to the report, major sources of NRI investments include the USA, Canada, Gulf Cooperation Council, UK, Singapore, Malaysia, etc. Gulf Cooperation Council is the biggest source of NRI investments, contributing to 42% of the total investment inflow. Since there is no citizenship option available in the Gulf region, it is common for the NRIs living there to invest in a home in India.

360 Realtors has been a leading player in the NRI space and tracking the NRI buying patterns over the years. Post RERA implementation, the confidence levels of NRIs have gone through the roof. Interestingly, NRIs are not buying for end-use, but many are entering the market with a pure-play investment purpose.

“NRIs will continue to get drawn towards the Indian real estate in big volume in the foreseeable future. Apart from an emotional connection with the country of their origin, a weakening Indian rupee & discounted prices of Indian properties will act as an important stimulant,” said Ankit Kansal, Founder & MD, 360 Realtors.