Real Estate expectations from Union Budget 2021

The Union Budget 2021 will be presented on 1st February by the Finance Minister, Nirmala Sitharaman. Given the bleak market scenario post-Covid-19 lockdown and the policy reforms undertaken by the government over the past couple of years, the real estate industry is hopeful that the upcoming budget will provide the much-needed impetus. The year 2020 saw the government take numerous steps to help improve market sentiment and revive real estate demand.

This time around, the sector expects the Budget 2021 to lower the GST rates on under-construction projects, provide income tax benefits, increase the NBFC credit liquidity, implement single-window clearances for project approvals, redefine the Affordable Housing price bracket, allocate additional funds for PMAY scheme, and fuel investment in infrastructure.

In this backdrop, Commonfloor conducted a real estate survey on builders across India to capture their expectations from the Budget 2021. More than 100 builders participated in this survey to express their views and expectations.

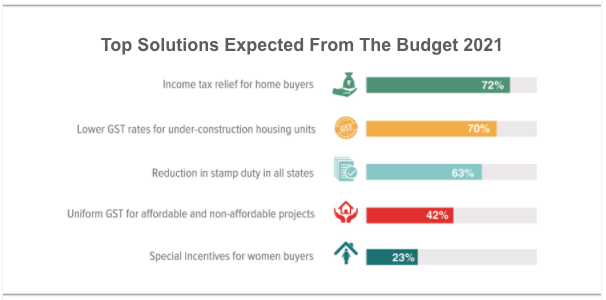

The majority of the builders (72%) expect the Budget to provide income tax relief to homebuyers. Another major chunk of the builders (70%) expect the Budget to lower the GST on under-construction projects. GST reduction clubbed with the revival of Input Tax Credit can provide relief to the builders and housing can be made available at lower prices. On August 26, the Maharashtra government decided to temporarily reduce stamp duty on housing units from 5 percent to 2 percent until December 31, 2020, to boost the stagnant real estate market hit by COVID-19. Stamp duty from January 1, 2021, until March 31, 2021, will be 3 percent. Later, the ready reckoner rates were hiked by 1.74 percent. 63% of the builders surveyed expect reduction of stamp duty in all states.

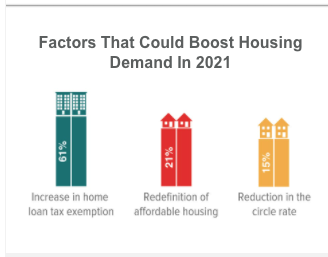

Around 60% of the builders surveyed feel that the increase in Home Loan tax exemption is the primary factor boosting real estate demand. A further extension to the existing 2-lakh tax rebate on home loan interest rates will push the fence-sitters to buy homes. It could result in a higher demand for housing, especially in the affordable and mid-segment categories.

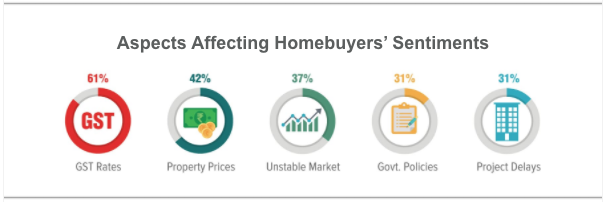

One-third of the builders surveyed feel that the GST rates are the most vital component hurting homebuyers’ sentiment. Apart from GST, project delays and high property prices are the other factors that affect consumer sentiments. Builders feel that the additional outlay of Rs 18,000-crore for the urban housing scheme is insufficient for the realty sector. Moreover, home loan interest rates and high government taxes such as stamp duty and registration could be reduced to propel demand in the market.

What leading builders are saying

Mr. Ashish R Puravankara, Managing Director, Puravankara says, “The real estate sector is hopeful of the upcoming Union Budget scheduled in February, to improve upon momentum built during the last few months in 2020. Several regulatory measures, such as reducing Stamp duty (in certain states) and favourable REPO rates, have created a conducive environment for buyers to invest in real estate projects. We are hoping to see additional announcements that can ease the industry’s burden. Currently, the cost of procuring raw materials like steel and cement for construction is very high. This hampers with the margins of builders and developers and could also cause a liquidity crunch for them. A reduction in the GST on building materials from the current 18% to 5% will be a game-changer. The move will bring relief to developers, and the benefits can be pass on to the end-user, which will further improve the buyers’ sentiments.

Mr. Ashish R Puravankara, Managing Director, Puravankara says, “The real estate sector is hopeful of the upcoming Union Budget scheduled in February, to improve upon momentum built during the last few months in 2020. Several regulatory measures, such as reducing Stamp duty (in certain states) and favourable REPO rates, have created a conducive environment for buyers to invest in real estate projects. We are hoping to see additional announcements that can ease the industry’s burden. Currently, the cost of procuring raw materials like steel and cement for construction is very high. This hampers with the margins of builders and developers and could also cause a liquidity crunch for them. A reduction in the GST on building materials from the current 18% to 5% will be a game-changer. The move will bring relief to developers, and the benefits can be pass on to the end-user, which will further improve the buyers’ sentiments.

The real estate sector contributes to nearly 8% of the employment generated in the country. It has been a long-standing request by the industry to be granted infrastructure status, which will enable easy access to finances with lower interests for developers, thereby making projects even more affordable to the end-user. The streamlining of approvals enforced by RERA and the introduction of the Single Window Clearance will ensure approvals to be processed more quickly for projects and further result in decreased construction costs, thereby reducing the stress on the developers and homebuyers.

Additionally, the real estate is a highly capital intensive industry, and in the current situation, only well-capitalized developers can deal with the liquidity challenges. Construction finance given to the developers to construct residential projects should be treated like a Housing loan and shall have a favourable interest like a Housing Finance. Also, the banks should be permitted to fund for land purchases provided the plan sanction is obtained within 12 months from the date of purchase. RBI loan restructuring will allow developers to re-plan their inflow as per their outflow and approach their investors accordingly.

The vision of ‘Housing for all by 2022’ will put an additional impetus of affordable homes. We are hopeful the government will bring relevant legislation to catalyze the segment further.

Mr. Navin Kumar, Director of Navin Housing says “Union Budget 2021 can become the sweetener that home buyers have been waiting for. The finance minister has promised a Big Bang Budget, a budget like never before in the History of Independent India. This unprecedented announcement has developed curiosity and expectations among all of us. As for me, my key expectations pertain to modification and extension of existing schemes of the government. To start with the scope of the PMAY Scheme should be extended by broadening the salary brackets up to Rs.30 lakh and the scheme itself shall be extended by one year. The GST concession for affordable homes which currently is up to Rs.45 lakh should be increased to Rs.75 lakh. Coming to Income Tax Exemption, currently interest paid on home loans up to Rs.2 lakh is deductible from taxable income. I wish this is increased to Rs.5 lakhs. I also hope the deduction for principal repayment of housing loan is doubled from the current Rs.1.5 lakh to Rs.3 lakh. Apart from these, re-introduction of Input Tax Credit on GST is another wish that I would like to see for our home buyers. Considering all my expectations of the Union Budget 2021 I believe that if the said alterations are made, it’ll be a no brainer for the buyers to buy which will help stimulate and sustain the demand for the real estate market.

Conclusion:

The implementation of the above-mentioned measures will help revive real estate growth to a great extent and give a thrust to home buying sentiments, which in turn will revive the economy. To generate cash flows for struggling builders, it is quite evident that the stress fund will be a big boost, but it would address only a small portion of the stalled projects. The rest could only be addressed by NBFCs and banks.

The real estate sector has long needed an industry status that can help to procure finances at a lower cost, especially now, when credit availability is a major headwind. The momentum of infrastructure development should continue from last year so that growth is decentralized and migration to urban centers remain under check. The real estate sector is optimistic that the upcoming budget will usher fresh stimulus in terms of bold fiscal measures to outperform its growth from last year.