stamp duty and registration charges

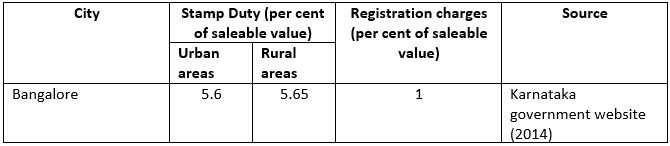

Bangalore: Stamp Duty & Registration Charges

Stamp duty and registration charges are important costs which every buyer has to pay while planning to buy his dream home. These charges vary from state to state. So, what are the stamp duty and registration charges in Bangalore? As per the ongoing rates, one has to pay 5 per cent of the registered value […]

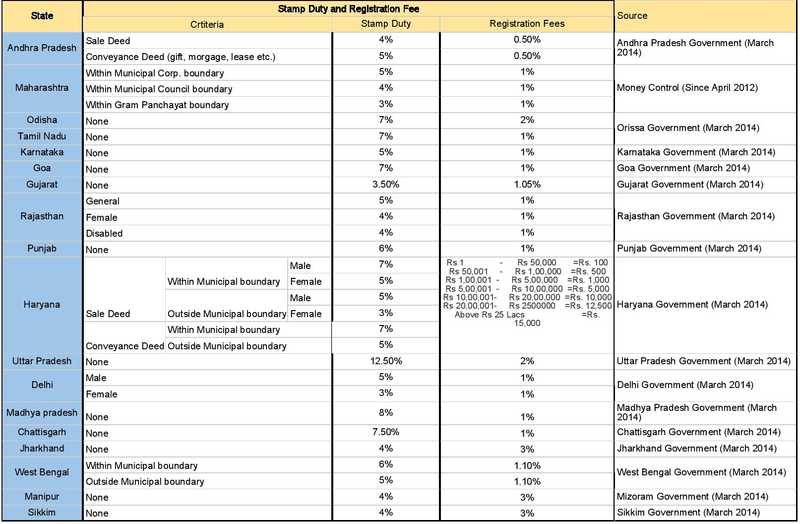

Stamp Duty and Registration Fee in States

The following article gives the stamp duty and property registration charges of all the states. Stamp duty and registration charges vary from state to state. Stamp duty charges and Registration fees in most of the states is given in the terms of percentage of the total value of transaction. The table given below can be […]