Cabinet Clears Stimulus Package and Widened MSME Definition

Highlights

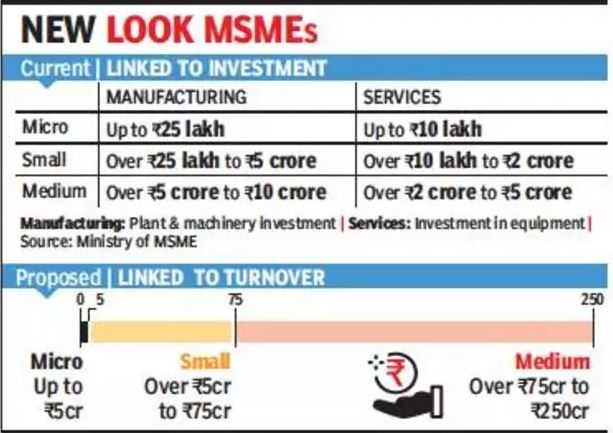

- According to the new outline, a company with up to Rs 50 crore investments and up to Rs 250 crore turnover is categorized as a medium enterprise.

- As per the new changes, businesses with an investment of less than Rs 1 crore and a turnover of Rs 5 crore would be classified as micro-enterprises.

- The investment limit of small enterprises has been increased to Rs 10 crore, and the companies would have to have a turnover of less than Rs 50 crore.

- The Cabinet also decided not to count exports while calculating the turnover and rejected the distinction between manufacturing and service-based MSMEs.

- The medium enterprises’ investment limit has been increased to Rs 20 crore and the turnover limit has been kept at Rs 100 crore.

- In order to help 2-lakh MSMEs, the Cabinet approved an Rs. 50,000 crore Distressed Assets’ Fund with the support of the Government’s share at Rs. 10,000 crores,.

- The Cabinet also approved the government’s equity of Rs 4,000 crore in another fund of Rs. 20,000 crore to assist stressed or NPA-categorised MSMEs.

- A credit scheme for street vendors has also been approved.

The Union Cabinet on Monday officially approved all announcements relating to MSMEs as part of the Rs. 20-lakh COVID-19 stimulus package as well as approved changes in the definition of MSMEs which was further polished after being announced an economic package by FM Nirmala Sitharaman under the “Aatmanirbhar Bharat” on 13th May.

MSME New Definition

Under the new definition, micro, medium, and small enterprises will individually use higher limits on turnover and capital without the concern of discarding their category. The Cabinet also decided not to count exports while calculating the turnover and rejected the difference between manufacturing and service-based MSMEs.

According to the new definition, a company with up to Rs 50 crore investments and up to Rs 250 crore turnover will consider as a medium enterprise.

Enterprises with Rs 1 crore investment and Rs 5 crore turnover would now qualify as micro-enterprises.

Businesses with an investment of less than Rs 10 crore and turnover less than Rs. 50 crore will now be classified as small enterprises.

Besides, the investment limit for medium enterprises has been increased to Rs 20 crore and the turnover limit has been kept at Rs 100 crore, which has now been extended to companies with an investment of Rs 50 crore and turnover of up to Rs 250 crore.

At present, around 63.4 million MSME units in India of which 6.3 crores are micro-enterprises, while 3.31 lakh were small enterprises and 5000 medium enterprises that contribute around 6.11% of manufacturing GDP and 24.63% of services GDP as well as 33.4 % of India’s manufacturing output. The changes would help over 6 crore MSMEs that collectively engaged 11 crore people. These announcements will help MSMEs to attract investment and job opportunities in the country said MSME and Transport Minister Nitin Gadkari.

Coronavirus Stimulus Package

Under the ”Aatmanirbhar Bharat” package, the government has also removed with the difference of services and manufacturing MSMEs.

In order to help 2-lakh MSMEs that have the potential but require a little support due to the COVID-19 disruption, the Cabinet approved an Rs. 50,000 crore Distressed Assets’ Fund with the support of the Government’s share at Rs. 10,000 crores. The government will set a fence of 85% for loans up to Rs 5 lakh and 75% for loans beyond Rs 5 lakh from financial institutions.

The Cabinet also approved the government’s equity of Rs 4,000 crore in another fund of Rs. 20,000 crore to support stressed or NPA-categorised MSMEs. The central government will put up Rs. 4,000 crore in a special trust and banks will compensate the rest to support nearly 2-lakhs MSMEs in a trust called “fund of fund”.

The cabinet has already launched, the 3rd and the largest component of the Rs. 3.70 lakh crore MSME stimulus package and Rs 3 lakh crore collateral-free loans. It has targeted at 45 lakh units that were closed and found it difficult to pay for wages and raw materials. The eligibility is for companies with up to Rs. 25 crores in outstanding loan or turnover of Rs 100 crore.

These loans will have a 4-year tenure and moratorium of one year with a 100% credit guarantee cover on principal and interest. The loan will be available till 31st October without charging guarantee fees or seeking fresh collateral.

The central government has already released MSMEs from new bankruptcy procedures for a year from the present 6-months and announced plans for an MSME-specific special bankruptcy framework. The central government is also planning to issue an Ordinance to increase the MSME insolvency limit from Rs 1 lakh to Rs 1 crore. Another Ordinance will decriminalize technical and procedural defaults under the Companies Act. 7-compoundable offenses will be rejected and 5 will be bought with an alternative framework.

What is MSME and kind of business comes under it?

MSME describes Micro, Small, and Medium Enterprises. It was developed under the MSMED Act 2006. MSME is classified into two different types: Manufacturing Sector and Service Sector.

Manufacturing Sector

Manufacturing enterprises are for the production or supply of goods relating to any industry as per the (Industries Development and Regulation) Act, 1951). The Manufacturing Enterprise is characterized for making an investment in the Plant and Machinery.

Service Sector

The Sectors which provide services to the people are included in the Service Enterprises.

There are various kinds of business which comes under these two sections of MSME, which are mentioned below:

- Leather products

- Glass and Ceramics

- Placement Consultancy Services

- IT Solution Provider.

- Xeroxing

- Engineering and Fabrication

- X-Ray Clinics

- Educational Institute

- Photographic lab

- Beauty Parlour

- STD/ISD Booths (Calling booths)

- Tailoring

- Laundry and Dry Cleaning

- Tailoring

- Mechanical Engineering Excluding Transport Equipment.

- Servicing of Agricultural Farm Equipment

- Pharmaceutical Ingredients which are active & Ayurvedic Products

- Retail Trade with low Capital

- Paper Products

- Automotive Electronic Component

- Bicycle parts

- Khadi Products

- Rubber Products

- Wood Products

- Auto Parts Components.

- Stationery Items.

- Flavors &Natural Fragrance

- Educational Institute

- Energy Efficient Pumps

- Garages

- Equipment Rental & Leasing

- Equipment Rental & Leasing

- Back Office Operation Relating to Computerised Data

- Dish cable T.V. with Dish Antenna

- Electronic Surveillance and Security

- Handicraft products

- Poultry Farm

- Computerized Call center

- Industrial Testing Labs

- Thermoplastic products like hairbrushes, umbrella frames, plastic toys, etc.

Image Sources: Times of India Quora