Maharashtra Stamp Act: An Overview On Stamp Duty And Registration Charges

Maharashtra Stamp Act Introduction

In India, the Indian Stamp Act, 1899 (ISA) is a central legislation, while states have their own local stamp act to administer with issues rising within that particular state. The Bombay Stamp Act, 1958 which came into force on 16 February 1969 (BSA), is a law for stamp duty within the state of Maharashtra. The Constitution of India permits both the Parliament and the State Legislature to make provisions and legislation for stamp duty within its limits. Accordingly, certain documents specified in the ISA are included. Under the BSA, an instrument is defined to include every document by which any right or obligation is, or is made, transferred, limited, extended, extinguished or recorded while a bill of exchange, checks, promissory notes, etc. is not included. These documents are excluded, as governed under the aforesaid ISA.

What is Maharashtra Stamp Act?

In Maharashtra, stamp papers could be purchased before 1 May 1994 in the names of advocates or by any other name. However, the stamp paper is to be purchased in the name of one of the parties thereafter. In addition, the validity of the stamp paper is restricted for a period of 6 months and if stamp paper is used thereafter, it is assumed that the document is executed on ordinary paper without a stamp.

If an instrument falls into Schedule I of the Bombay Stamp Act (BSA) with several duties rates, the instrument is chargeable with the highest of the prescribed fees. Apart from this, the BSA also prescribes a methodology for adjournment (proper assessment), the refund of duties, grievance procedures and defects, etc. The Collector is usually authorized or vested with the power to authorize. If a document is not stamped or appropriately stamped, it is likely to be affixed.

The Act was recently amended and amendments include revision of stamp duty on gift deeds, e-payment of stamp duty, amendment of penalty sections, and increase in stamp duty under certain instrument clauses.

What Is Stamp Duty?

Stamp duty is a type of tax, such as sales/income tax, etc. and its basic purpose is to raise revenue for the government. Thus, like any other tax, the stamp duty will have to be paid to the government in full and on time, with a delay with penalties. In general, stamp duty is levied on an instrument (and not on a transaction); stamp duty is payable on the property (whether immovable/movable or tangible/intangible) either on a fixed basis or on the basis of the consideration mentioned in the instrument as the case may be. In the case of immovable property, there is an additional theory of valuation of the property, which is also taken into account while deciding the stamp duty payable.

How Is Stamp Duty Calculated?

The stamp duty is calculated based on the ready reckoner rates and the property value mentioned in the buyer-seller agreement. In Maharashtra, stamp duty on the property varies by location. For example, stamp duty for a property located in the municipal limit of urban areas in Mumbai will be 5% of the market value, while a property located within the limits of any gram panchayat will attract stamp duty of 3% of the market value.

Stamp Duty And Registration Charges In Maharashtra

The stamp duty rates on property depend on several measures in the state of Maharashtra. This includes whether the property is located in urban or rural areas, the total cost of the transaction, etc. Recently, the Maharashtra government has reduced the stamp duty on properties for the next two years in areas falling under the Mumbai Metropolitan Region Development Authority. (MMRDA) and the municipal corporations of Pune, Pimpri-Chinchwad, and Nagpur.

This means that stamp duty on properties in Mumbai, Pune, and Nagpur, will be charged at 5% (4% stamp duty + 1% metro cess).

| Stamp Duty & Registration Charges in Maharashtra 2020 | ||

| Cities | Stamp Duty Rates From 1st April 2020 | Registration Charges |

| Mumbai | 5% (Stamp duty 4% + Metro Cess 1%) |

|

| Navi Mumbai | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) |

|

| Thane | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) |

|

| Pune | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) |

|

| Pimpri-Chinchwad | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) |

|

| Nagpur | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) |

|

Moreover, according to Article 34 of the Maharashtra Stamp Act, which was revised in 2017, stamp duty on gift deeds is 3% of the property’s value. However, if the property in consideration is a residential or agricultural property and is gifted (without any payment) to family members, then, the stamp duty is Rs 200.

Factors that Determine Your Fee on Stamp Duty & Registration

Stamp duty and registration charges are imposed by the state governments on homebuyers. These apply to both freehold and leasehold land (agricultural and non-agricultural) as well as other types of properties such as homes, flats, or commercial properties. There are certain factors that determine how much stamp duty is in Mumbai and registration will be payable:

- Type of property

The fees on residential will be comparatively less than a commercial property.

- The type of location

Properties in rural areas, as well as semi-urban areas, have to pay significantly less than in posh areas.

- Market Value

The market value of the property and the area of the property are taken into account for the calculation of stamp duty charges.

How To Pay Stamp Duty & Registration Charges Online In Mumbai?

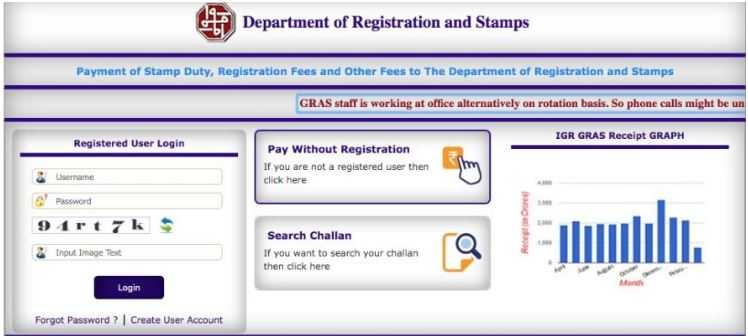

In Mumbai, you can go for payment of these charges through both online and offline mediums. The Government of Maharashtra has a dedicated portal ‘Government Receipt Accounting System’ (GRAS) in which you are required to enter all the necessary details about the property and its documents and make payments accordingly. Homebuyers must follow a few easy steps to pay the stamp duty and registration charges in Mumbai on the purchase of the property.

Step 1: Visit the Maharashtra Stamp Duty Online Payment Portal.

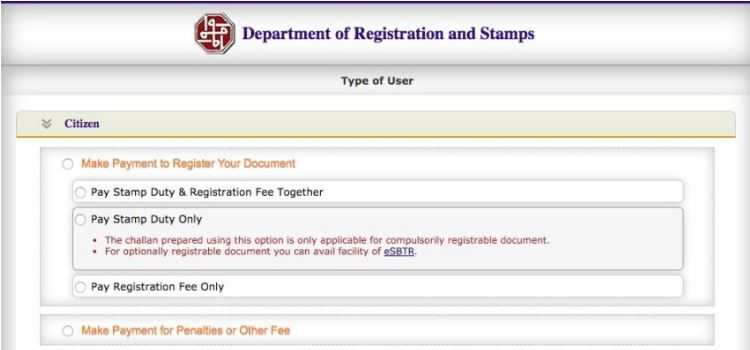

Step 2: If you are not registered with the portal, click ‘Pay without registration’. If you are a registered user, please fill in the login details.

Step 3: If you have selected the option ‘Without Pay Without Registration’, you will be directed to another page, where you will have to select ‘select citizen’ and select the type of transaction you want to do.

Step 4: Select ‘Pay to register your document’. Now, you can choose to pay stamp duty and registration fee together or only stamp duty or registration fee only.

Step 5: Fill in the required details such as District, Sub-Registrar office, Payment details, Party details, Property details, and Property value details.

Step 6: Select the payment option and once completed, generate the challan, which will have to be submitted at the time of execution of the deed.

If you are doubtful or stuck at any step or you want to recreate your invoice, you can leave a mail at vtodat.mum-mh@gov.in

Modes of Payment of Stamp Duty in Maharashtra

There are 4 modes of payment of Stamp Duty in Maharashtra:

- Non-judicial Stamp Papers – This is the traditional but cumbersome and time-consuming mode of stamping, and forces one to obtain physical stamp paper by engaging with licensed vendors. The instrument to be executed is printed on such stamp paper. This option is not practicable in cases where stamp duty of larger denominations is required to be paid.

- Franking a document – The process of franking a document requires submitting an application with an authorized bank or franking agency to pay stamp duty and stamp (using the vending machine) by the authorized bank or franking agency on the document denotes value. Franklin can only be done before the execution of the document and the maximum stamp duty cap is Rs. 5000 / document.

- e-SBTR/Electronic Secured Bank Treasury Receipt – E-SBTR is an online payment service for payment of stamp duty through an electronic payment gateway. For this one has to fill the filling ‘input form’ at the branch office with any bank providing e-SBTR facility and pay the required amount of stamp duty. The bank then records these details in the Government Virtual Treasury and creates an e-SBTR on the special government pre-printed secure stationery which serves as proof of payment of stamp duty. Since the e-SBTR is issued on a special government stamp, it is necessary to physically collect an e-SBTR from the respective branch of the bank upon the presentation of the confirmation of online payment for the print of input form and stamp duty.

- GRAS/Government Receipt Accounting System – Like e-SBTR GRAS, there is an online payment of stamp duty through an electronic payment system. However, under an e-SBTR mechanism, there is no need to physically go to the respective branch of the banks as recognition of e-challan generated online under GRAS as an accepted method of payment in sub-registrar offices and other offices of the department. Although a completely online process, GRAS has the limitation that it can only be used for compulsory registrable documents (under Section 17 of the Registration Act, 1908), including, inter alia, the right, title, and interest to or in immovable property. In financing transactions, therefore, this mode of payment will only be available for documents such as mortgages and cannot be used to pay stamp duty on other important but non-mandatory mandatory documents such as loan agreements, security and guarantee documents.

Recent Clarification on Stamp Duty in Maharashtra

Providing some relief to the Office of Inspector General of Registration and Controller General of Maharashtra through a circular dated 27th April 2020 and notified certain relaxations in relation to (a) Some exemptions have been notified in respect of filing of information (in the matter of financing, transactions required for the creation of mortgages on immovable property, through title deeds or deposits of similar mortgages):): and (b) Payment of stamp duty on non-compulsory registrable financing documents executed during the nationwide lockout period. The fee/exemption offered under the circular is summarized in the table below.

| Relevant Provision | Position Post Issuance of Circular |

| Section 17 of the Maharashtra Stamp Act | Stamp duty on all instruments, banks and other similar organizations cannot be paid for the registration activities related to financing activities and compulsorily registrable, can be paid within one working day of lifting the lockdown in such districts and Payment will be considered within one business day shall be considered to be sufficient compliance of section 17. This one-day exemption is not granted in relation to other means (i.e. for transactions other than financing transactions), thereby limiting the circumstances on the stamping of such other documents. |

| Section 89B of the Registration Act, 1908 | In such districts, information can be given within one day of the lifting of the lockdown. Banks and other agencies can use the online platform available on igrmaharashtra.gov.in for online filing. The circular also clarifies that in light of the COVID-19 epidemic, the administration intends to stop the practice of physical filing of intimation of intimacy from 1st June 2020. |

Stamp Duty News

- On 6 March 2020, the Maha Vikas Aghadi (MVA) government in its landmark decision announced a 1% stamp duty concession and other related charges applicable to the registration of documents in areas falling under the Mumbai Metropolitan Region Development Authority (MMRDA) and Municipal Corporations of Pune, Pimpri-Chinchwad, and Nagpur by 2022.

- On 31st March 2020, the Central Government has extended the applicability of stamp duty by 3 months. The provisions of the amended Indian Stamp Act, which were to come into force from 1 April 2020, will now come into force from 1 July 2020.

- On 11th May 2020, the Maharashtra government has lost Rs 3885 crore in stamp duty in 40 days of lockdown. The state government has earned only Rs 15 crore through stamp duty and registration in the last 40 days – a steep fall in comparison to the Rs 4000 crore it usually generates in such a period.

- On 28th May 2020, the Maharashtra Government has announced 1% concession of stamp duty.

Data Source: Google, Image source: https://gras.mahakosh.gov.in/