Income-tax Act

Budget 2014:Govt plans big changes in 2 Realty Bills

Two bills that would impact the country’s real estate are the Real Estate Regulatory Bill and the Land Acquisition Act. While both bills had been put forward during the previous government, the present government plans to make a few key changes in order to speed up important projects and give a boost to real estate. […]

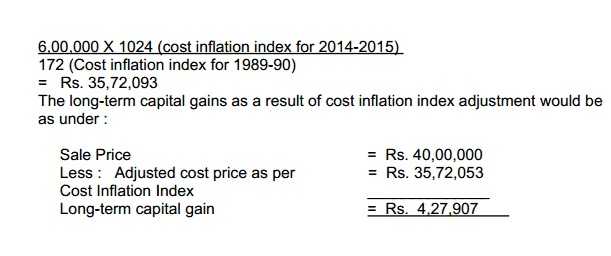

Saving Income Tax during Financial Year 2014-2015 on Property Gains through Cost Inflation Index

It is really possible to save substantial amount of Income-tax on your long-term capital gains arising out of selling your immovable property if you take advantage of the Cost Inflation Index concept which, however, is applicable only in respect of long-term capital gains. Only when you hold your property for more than 36 months and […]