Section 80C

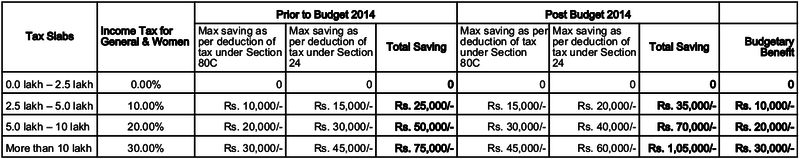

Budgetary benefits for Individual Home Loan Borrowers

Buying a home is the most common investment option in the current scenario. In addition to garnering higher profits, through home loan route, it also empowers individuals with successful tax savings. Thus, banks are not just targeting the individuals who do not have adequate resources, but for generic public who doesn’t need them and are […]

Budget 2014: Direct tax code breathed a new life

The maiden budget under the regime of Modi’s government, was a mere litmus test as big investors, corporates and stakeholders, expecting major economic reforms keep a watchful eye. The budget 2014-15, left the income tax rates unchanged, however it offered sops to small assesses, by increasing the threshold exemption limit from Rs 2 lakh to […]