RBI Monetary Policy: Keeps Repo Rate Unchanged At 4%

RBI Monetary Policy 2021

The Reserve Bank of India (RBI) in its first monetary policy meeting after the Union Budget 2021-22 has decided to maintain a status quo on key policy rates. The 6-member Monetary Policy Committee (MPC) directed by RBI Governor Shaktikanta Das kept the repo rate and reverse repo rate unchanged at 4% and 3.35% respectively as part of the emergency response to the pandemic.

The MPC had called for a 3-day meeting from 4th to 6th August. 6-members of the MPC include Chetan Ghate, Pami Dua, Ravindra H Dholakia, Mridul K Saggar, Michael Devavrat Patra, and Shaktikanta Das voted collectively to keep the representative rate unchanged.

The RBI last revised its policy rate on May 22, 2020, to reduce the historical rate by lowering interest rates in an off-policy period to raise demand. In fact, it has lowered its policy rates by at least 110 basis points since March 2020, with the aim of making the economy suffer the difficulties caused by the COVID-pandemic.

“Inflation was better in the December meeting and reduced below the sensitivity level of 6% and CPI inflation upgrades were revised to 5.2% from January to March 2021,” he said.

Current Key Rates

| Repo Rate | 4% |

| Reverse Repo Rate | 3.35% |

| Marginal Standing Facility Rate | 4.65% |

| Bank Rate | 4.65% |

| CRR | 3% |

| SLR | 18% |

The Repo rate is the rate at which the RBI lends funds to commercial banks while the reverse repo rate is at which it borrows from banks when required. In 2020, the RBI had already cut 115 basis points. Now, the Repo rate is 4%, and the reverse repo rate is 3.35%.What is REPO RATE?

A rate cut was much expected as the central bank tries to support an economy that is expected to decline last financial year.

What is Reverse Repo Rate?

When the Reserve Bank of India faces a financial crisis, they invite commercial banks and other financial institutions to deposit their surplus funds in the RBI treasury and offer them an excellent interest rate. Similarly, when banks have more money, they willingly transfer it to the RBI because their money is safe and secure with them. Generally, the reverse repo rate is always lower than the repo rate.

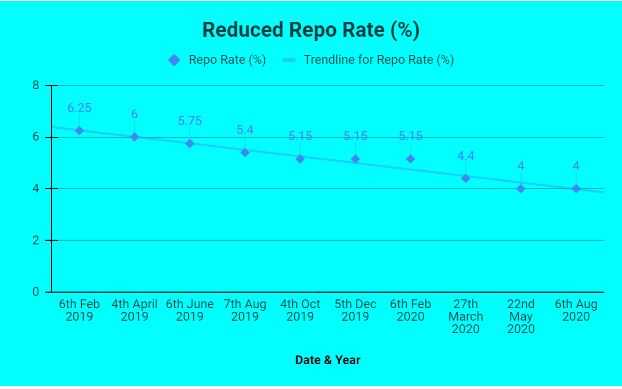

How Repo Rate (%) Changed 10th Times In One and Half Year

| Date & Year | Repo Rate (%) |

| 6th Feb 2019 | 6.25 |

| 4th April 2019 | 6 |

| 6th June 2019 | 5.75 |

| 7th Aug 2019 | 5.4 |

| 4th Oct 2019 | 5.15 |

| 5th Dec 2019 | 5.15 |

| 6th Feb 2020 | 5.15 |

| 27th March 2020 | 4.4 |

| 22nd May 2020 | 4 |

| 6th Aug 2020 | 4 |

As India moves to recover normalcy after the Coronavirus pandemic-induced economic catastrophe, the top bank hopes to maintain rates at this level through at least 2023, a Reuters poll indicated earlier.

Pointing to the improvement in the economy along with the signs of development in the list of common areas, RBI Governor Shaktikanta Das said that with the supply and demand both have been improved, India’s housing sector also noted some signs of recovery amid improving consumer sentiment.

“The Union Budget 2021-22 has proposed various steps to give reason to development. The forecasted increase in capital expenditure predicts well for capability building, through improving the possibility of growth around the quality of expenditure and reliability of construction. However, the recovery is still to meet strong traction and hence continued policy support is important, ”said Das.

RBI Monetary Policy 2021 and Its Impact on Housing Demand

Since home loan interest rates are already at a record low with most banks in India are offering home loans at less than 7%, and the chances of further change are narrow. However, demand for houses will remain strong due to various factors.

“RBI’s decision to keep policy rates stable is welcome and shows the government’s focus on fuelling consumption. Considering that the economy is on the way to recovery, the whole focus will now be on how the government’s demand will grow, and much needs to be done to improve the pace of growth in the region, ”Surendra Hiranandani, Chairman, and Managing Director, House of Hiranandani.

“There is a need to support economic growth through monetary policy, and this is the most important reason why RBI has continued its aggressive stance. It has centered on balancing liquidity in the financial system while maintaining inflation within its target. NAREDCO Maharashtra president Ashok Mohanani said that interest rates will continue at record levels, but banks should pass on the benefits to customers, which will increase the demand for real estate.

Impact On Home Loan Interest Rates

This is the 3rd time in a row that RBI’s Monetary Policy Committee has decided to keep the rates unchanged. The RBI last revised its policy rate on May 22, 2020.

Since home loan interest rates are already at a record low with most banks in India are offering home loans at less than 7%, and the chances of further change are narrow. However, demand for houses will remain strong due to various factors.

According to SBI chairman Dinesh Kumar Khara, lending rates are ‘really down’ and will remain at these levels for some time until the economy improves.

However, sector experts are of the opinion that low-interest rates and various other measures have been recorded by RBI in the past to support the real estate sector, which will continue to boost demand in the residential housing segment.

RBI Kept Repo Rate Unchanged Over Inflation Concerns

The RBI has kept the repo rate unchanged ensuring that inflation remains within the target, consumer price-based inflation in India jumping to 7.61% in October, above the RBI’s comfort zone of 4%, while GDP of 7.5% was lower than the central bank’s forecast of 8.6% in the July-September quarter.

“Rural demand is expected to recover further, while urban demand is also opening spurs activity and employment, especially of labor migrated by COVID-19. However, these positive impulses have been encouraged by some standards of local restriction, due to the possible increase of infection in some parts of the country. At the same time, the recovery rate has crossed 94% and there is considerable optimism on the successes in vaccine trials, ”RBI said in its policy statement.