Guide to pay 2012-13 BBMP Property Tax Online

BBMP Bangalore has started accepting property tax for property in Bangalore for the financial year 2014-15 since April 1st, 2014.BBMP (Bruhat Bengaluru Mahanagara Palike) had offered a discount of 5 per cent on your property tax if it was paid before April 30th, 2014.Solid Waste Management Cess (SWM Cess) should be paid along with property tax at yearly or half yearly rates. The process of payment is similar to last year and there is no change in either property tax or in garbage cess. Property taxes can be paid according to the Self Assessment Scheme (without taking additional depreciation towards age of the building).

BBMP Bangalore has started accepting property tax for property in Bangalore for the financial year 2014-15 since April 1st, 2014.BBMP (Bruhat Bengaluru Mahanagara Palike) had offered a discount of 5 per cent on your property tax if it was paid before April 30th, 2014.Solid Waste Management Cess (SWM Cess) should be paid along with property tax at yearly or half yearly rates. The process of payment is similar to last year and there is no change in either property tax or in garbage cess. Property taxes can be paid according to the Self Assessment Scheme (without taking additional depreciation towards age of the building).

Pay BBMP property tax online

You need to enter SAS 2008–09 Application No or Old PID Number of property, to pay property tax online. This is incase you have submitted declarations for the year 2008-09 . You can pay property tax in two equal instalments or one payment for the full year. If you pay your property tax on or before April 30 you can avail a rebate of 5% on property tax. If the property tax return for the previous year is not filed, payment of the current year’s property tax will not be accepted by BBMP Bangalore. Debit or Credit cards can be used for online property tax payment and there are no extra charges or transaction fees. The instructions for online payment of property tax are as follows;Visit https://1113.sasbbmp.com/ for paying the current year property tax.

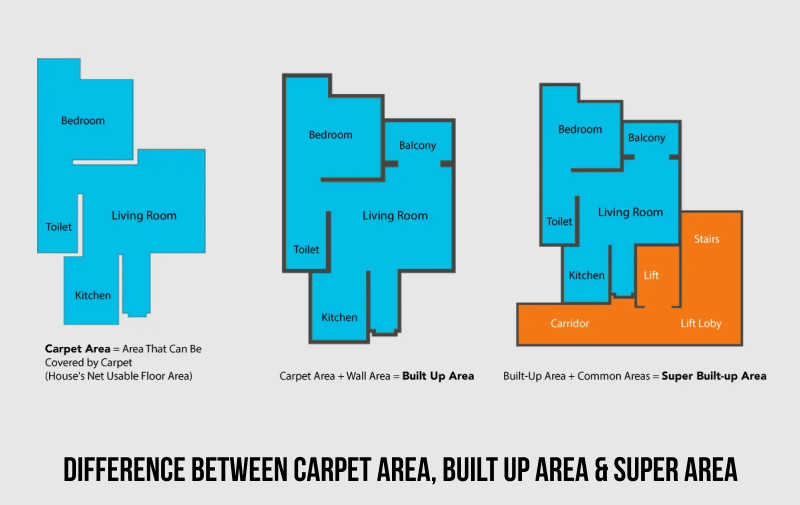

Incase there are no changes that need to be entered with regards to your property with regards to built-up area, usage or occupancy compared to the previous year, then you can fill Form IV; else you need to fill form V. To make payment of your property tax through Form IV, Click on the link: http://1113.sasbbmp.com/Forms/frm_OnlinePayment_Form4.aspx?Y=2014-2015

Read the Instructions and Enter the SAS 2008 – 09 Application No or Old PID NO and in the given list select the Owner Name for the Paid Tax in the Assessment Year 2008-09.

Fill the details and enter payment mode. For online property tax payment, Debit or Credit cards can be used and there are no extra charges or transaction fee.

Separate returns for the Solid Waste Management (SWM) Cess should be submitted along with property tax returns. If you have paid the property tax in two instalments for the current year, then two separate forms should be filled for each half year.

Types of Forms:

There are two forms which can be used to pay the property tax online. They are as followed;

Form IV (White form): Should be filed by those property owners where there is no change either in the extent of built up area, usage (residential to non-residential or vice versa) or its occupancy (owner occupied to tenanted or vice-versa), or category from the Return filed in the previous year.

Form V (Blue form) : Should be filed by those property owners who have made changes either in the extent of built up area, usage (residential to non-residential or vice versa) or its occupancy (owner occupied to tenanted or vice-versa), or change in category or vacant land to new completed construction from the Return filed in the previous year. BBMP Bangalore offers online property tax calculator to calculate Your Property Tax Online and file returns.

Solid Waste Management Cess:

BBMP has been collecting SWM Cess for buildings based on Plinth Area (total built-up area). Solid Waste Management Cess (SWM Cess) should be paid along with property tax half year or full year as in the case of the property tax. A single cheque can be paid for property tax as well as the SWM cess and the person will receive a single receipt for both. As mentioned earlier, it can be paid through a credit card or a debit card.

Bangalore SWM Cess Rate

The rates for the Solid waste management cess for this year are as follows:

For Residential Buildings

• Plinth Area (total built-up area) up to 1000sft. Rs 10 per month

• Area not less than 1001 sq. ft and not more than 3000 sft. Rs 30 per month

• Area above 3000 sq. ft. Rs 50 per month

Commercial Buildings

• Plinth Area up to 1000sq. ft. Rs 50 per month

• Plinth area not less than 1001 sq. ft and not more than 5000 sft. Rs 100 per month

• Plinth area above 5000 sq. ft. Rs 200 per month

Industrial Buildings

• Plinth area up to 1000 sq. ft. Rs 100 per month

• Plinth area not less than 1001 sq. ft and not more than 5000 sft. Rs 200 per month

• Plinth area above 5000 sq. ft. Rs 300 per month

Hotels, Kalyana Mantapa and Nursing home

• Plinth Area up to 1000sq. ft. Rs 300 per month

• Plinth area not less than 1001 sft and not more than 5000 sq. ft. Rs 500 per month

• Plinth area above 5000 sq. ft. Rs 600 per month

Door-to-door collection drive to collect tax amount from defaulters isplanned by BBMP Bangalore as in previous years. As usual, BBMP property tax will be collected in all Bangalore One centres and BBMP help centres. This year, tax amount will be collected at all the 54 Assistant Revenue offices.

One more month to get Rebate

BBMP Bangalore decided to extend the deadline for one more month. Earlier, the property owners who make their payments in full for year 2012-13 before April 30 could get rebate of 5% and now BBMP has extended the deadline for one more month. The new deadline is May 30, 2012. According to source, 4.75 lakh property owners have paid tax and as on April 28, 2012, BBMP Bangalore collected Rs 410 crore against Rs 290 crore in previous year.

Tax Calendar:

May 30, 2012: The property owner paying property tax in full for year 2012-13 on or before May 30 will avail a rebate of 5 %.

Last date to pay first half-year property tax 2012-13 & Solid Waste Management Cess without penalty. Last date for first half-year property tax too may extended for one month.

Nov 29, 2012: Last date to pay second half-year property tax 2012-13.

To make it more convenient, receipts will be issued to the customers immediately if the amount is less than Rs. 15000 and for amount exceeding Rs 15,000, paid through cheque, demand draft or pay order, acknowledgement receipt will be issued on payment and receipts only after encashment of cheques.

Also read:

BBMP Property Tax For The Year 2011-12

Bangalore Solid Waste Management Cess

How To Make Online Payment of BBMP Property Tax 2011-12